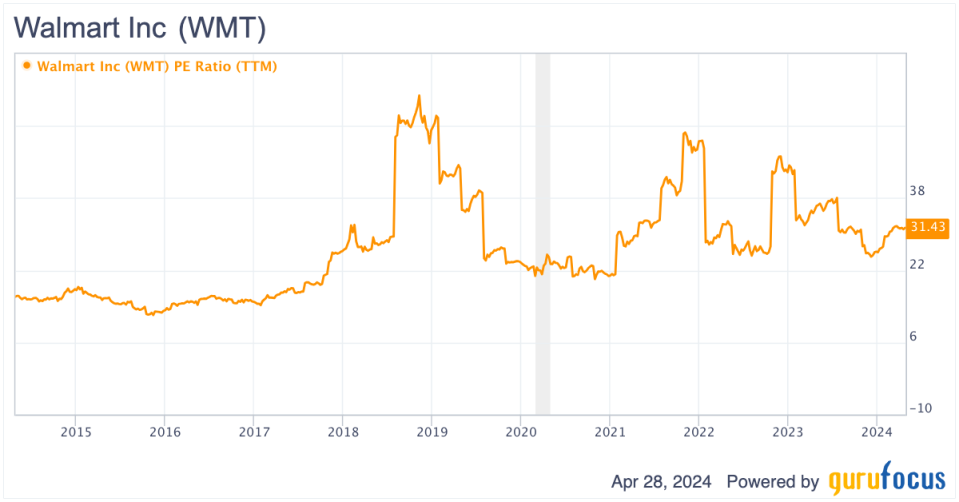

Walmart Inc. (NYSE:WMT) trades at roughly 25 times consensus fiscal year 2025 earnings per share. Comparably, the S&P 500 trades at roughly 20 times forward earnings, while key competitors such as Target (NYSE:TGT) tend to trade at somewhat lower valuations.

Investing guru Warren Buffett (Trades, Portfolio) previously owned shares of Walmart, but sold out of his position in 2016, noting that retail is a tough business.

Despite operating in a very challenging market, Walmart has delivered strong results for investors historically and has built up a durable competitive advantage.

Company overview

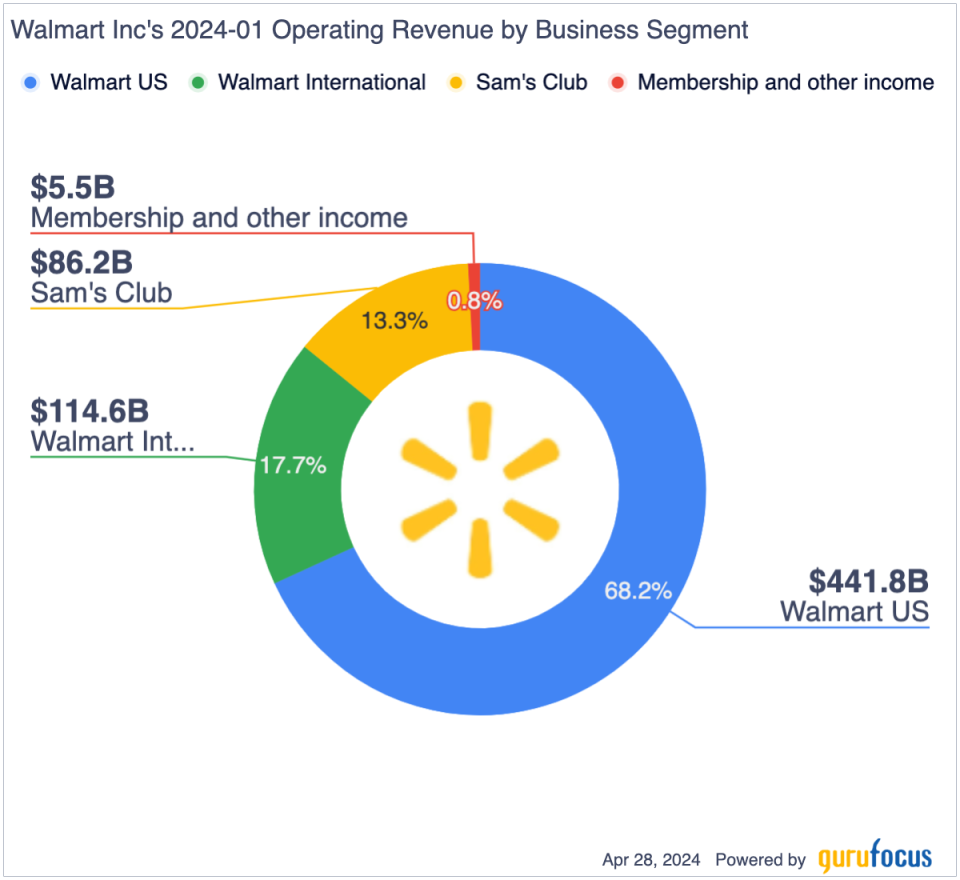

Walmart is a leading global retailer with more than 10,500 stores across 19 countries. The company operates three divisions: Walmart U.S., Walmart International and Sam's Club U.S. Walmart U.S. is the company's most important market and accounts for nearly 70% of its total sales. Key international markets include Mexico and Central America, Canada and China.

While the majority of Walmart's revenues are generated through sales at physical locations, it has a robust online business that accounts for roughly 18% of global sales.

The company sells a wide variety of products. Key product categories include groceries, general merchandise, health and wellness products and other. The grocery category is Walmart's largest merchandise category and accounts for nearly 60% of its U.S. sales.

Competitive advantages

The retail business globally is highly competitive. Walmart's key competitors include Target, Kroger (NYSE:KR), Costco (NASDAQ:COST), Dollar General (NYSE:DG), TJX Companies (NYSE:TJX), Aldi, BJ's Wholesale Club (NYSE:BJ), Amazon (NASDAQ:AMZN), Temu, Shien and many others.

Given this highly competitive landscape, Walmart stands out due to the competitive advantage it enjoys due to size. With annual revenue of approximately $648 billion, Walmart is considerably larger than its key competitors. Amazon generates annual revenue of roughly $484 billion, excluding its AWS segment. Kroger, Costco, and Target generate annual revenue of $150 billion, $238 billion and $107 billion respectively.

Walmart is able to exert strong negotiating power with suppliers due to its scale, which allows it to sell to consumers at lower prices. Additionally, the company enjoys other advantages due to its scale, such as being able to run a highly efficient supply chain, make significant investments in technology and spread marketing spend over a higher volume of sales.

I view Walmart's competitive advantage as highly durable given its significant scale advantage over competitors. In particular, the retailer's competitive advantage is especially strong in its core grocery business as the threat from Amazon, arguably its toughest competitor on cost, is less significant in this space.

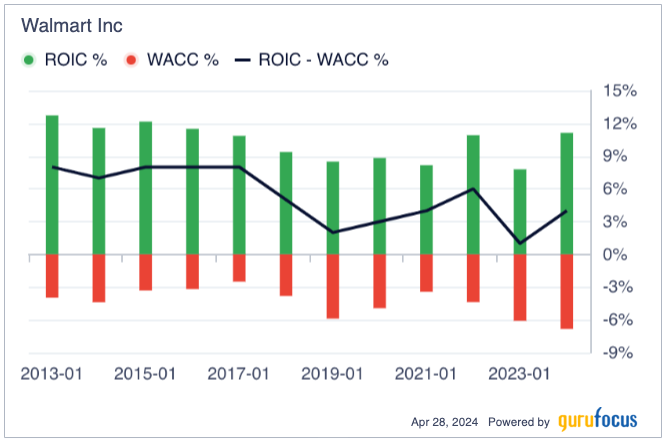

As a result of these competitive advantages, as shown by the chart below, Walmart has been able to deliver fairly consistent returns on invested capital above its weighted average cost of capital.

Growth potential

For fiscal 2025, Walmart expects to increase net sales by 3% to 4% on a year-over-year basis. The company expects adjusted earnings per share to increase by roughly 4% based on the midpoint of company guidance for adjusted earnings per share of $2.23 to $2.37.

Consensus estimates currently call for the company to deliver revenue growth of 4.30% and adjusted earnings per share of $2.36, which represents growth of roughly 6.60% for fiscal 2025. Thus, Wall Street analysts are optimistic the company will be able to deliver results toward the very upper end of company provided guidance. Moreover, Wall Street's consensus adjusted earnings per share estimates for fiscal 2026 and 2027 call for adjusted earnings per share growth of 9.30% and 10.90% respectively, while annual revenue growth is expected to remain around 4%.

Over the next few years, the key earnings growth drivers for Walmart will be its international division, margin expansion due to increased efficiencies and ancillary businesses such as advertising, which grew to $3.40 billion in fiscal 2024, up 28% on a year-over-year basis.

While I am optimistic the company will be able to deliver solid results for fiscal 2025 that are in line with consensus estimates, I believe delivering accelerating growth for 2026 and 2027 will be more challenging.

Reasonable valuation

Walmart currently trades at roughly 25 times consensus fiscal 2025 adjusted earnings per share. This represents a moderate premium to the broader market, which trades at close to 20 times forward earnings. In addition to trading at a higher multiple than the broader market, Walmart also has somewhat lower near-term growth prospects than the broader market. Currently, consensus estimates call for the S&P 500 to grow earnings by nearly 11% for 2024 and nearly 14% in 2025, while Walmart is expected to grow earnings at 6.60% and 9.30% over the next two years.

While the retailer's lower growth prospects compared to the broader market argue for a discount, its recession-resilient business model argues for a premium. The less cyclical nature of Walmart's business argues for a valuation premium as its earnings tend to be less volatile than more economically sensitive companies. While Walmart is exposed to general trends in consumer spending, as the low-cost retailer across many products, the company tends to benefit during times of economic stress as consumers look to cut costs. Evidence for the company's low degree of cyclicality can be seen in its relatively low historical beta, which, based on a three-year trailing basis, has averaged around 0.41 over the past 10 years.

Over the past decade, Walmart has traded at an average price-earnings ratio of roughly 27, while the S&P 500 has traded at an average forward price-earnings ratio of close to 18. Thus, the stock has historically traded at a premium valuation to the broader market and the current valuation premium appears reasonable relative to historical norms. Moreover, Walmart's valuation relative to peers also seems reasonable. Costco, a company with somewhat higher near-term growth expectations, trades at nearly 46 times forward earnings, while Target trades at 17.50 times forward earnings.

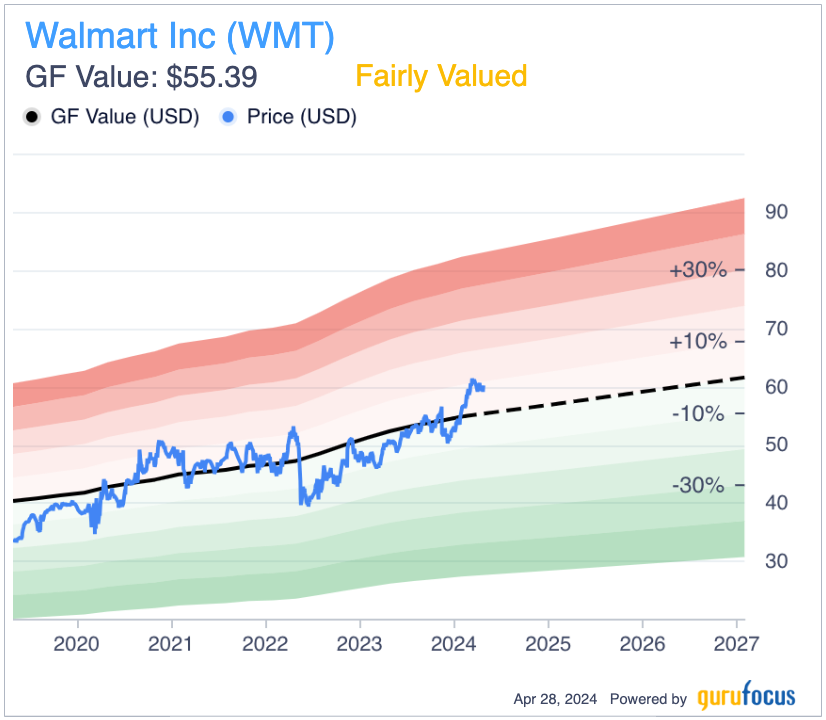

Walmart currently has a GF Value of roughly $55 per share, which suggests the stock is reasonably valued at current levels. I agree with this characterization and view the stock as reasonably valued due to historical norms and the stock's valuation relative to the broader market.

WMT Data by GuruFocus

Risks to consider

Perhaps the biggest risk to the bull case is that Walmart fails to deliver high levels of growth from its international business over the long term. The company's U.S. business is very mature and thus, if it is going to be able to deliver long-term earnings growth above the mid-single digits, the international segment must play a key role. As a U.S.-based company Walmart faces cultural challenges when executing in foreign markets and, at times, has struggled with its international business. In recent years, Walmart has pulled back from its business in key markets such as Japan and the United Kingdom. Operating internationally is challenging for Walmart as it generally lacks the substantial scale advantage that it enjoys in the U.S. Moreover, local players often have strong relationships with consumers and can prove challenging competitors.

Another key risk Walmart faces is potential unionization of part of its workforce. While the company has thus far been successful in avoiding unionization of its workforce, unions have been enjoying a period of increased favor lately and Walmart is currently subject to a National Labor Relations Board complaint, which alleges it used illegal tactics to deter unionization of a California store. The retailer would likely face increased labor costs in the event of a significant unionization of its workforce, which has the potential to hurt margins.

Conclusion

Walmart shares trade at a moderate premium relative to the broader market. The company operates in a highly competitive industry with thin profit margins, but has been able to generate solid returns due to competitive advantages related to the company's scale. I expect this competitive advantage to continue as Walmart has a significant scale advantage versus competitors.

While the company has growth prospects which are generally lower than the broader market, it benefits from a highly recession-resilient business. For this reason, the stock has historically traded at a premium valuation relative to the broader market. Moreover, Walmart trades at a reasonable valuation versus peers such as Costco and Target.

For these reasons, I believe Walmart is deserving of its premium valuation and is not overvalued at current levels.

This article first appeared on GuruFocus.

Bagikan Berita Ini

0 Response to "Does Walmart Deserve Its Premium Valuation? - Yahoo Finance"

Post a Comment